What happens to a fortune when a beloved celebrity passes away? The legacy of Andy Griffith, a name synonymous with warmth and comedic genius, leaves behind not only a wealth of cherished memories but also a complex question of inheritance, a financial estate valued at a considerable $60 million.

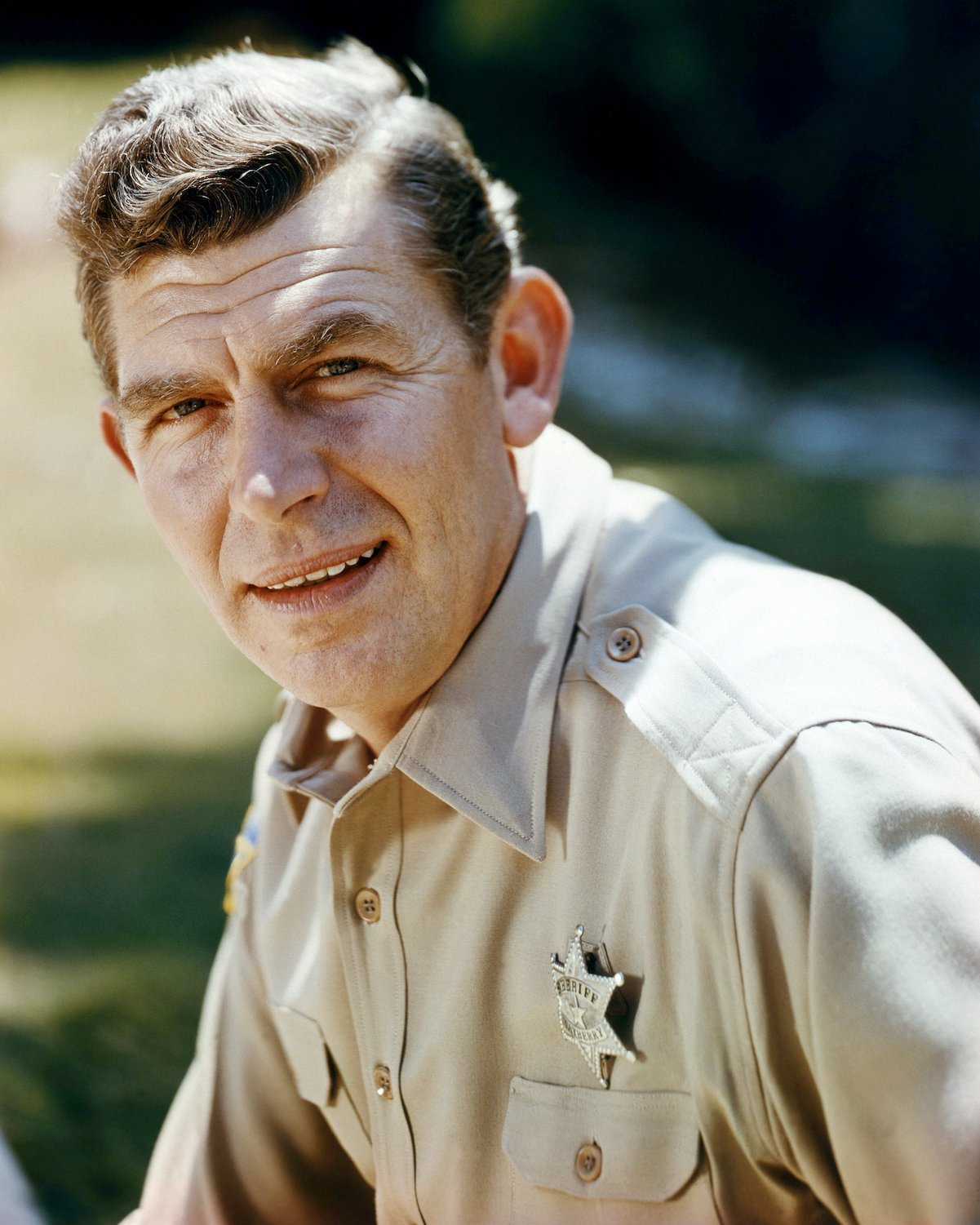

Andy Griffith, an American actor and singer, etched his name into the annals of television history with his endearing portrayal of Sheriff Andy Taylor in "The Andy Griffith Show" and the sharp-witted attorney Ben Matlock in "Matlock." His ability to connect with audiences through his relatable characters and down-to-earth charm solidified his place as a true icon. Born on June 1, 1926, in Mount Airy, North Carolina, Griffith's journey from a small-town boy to a national treasure is a testament to his talent and perseverance. He wasn't just an actor; he was a cultural touchstone, a figure who brought joy and laughter into millions of homes.

Beyond the television screen, Griffiths life was marked by personal relationships and experiences. His three marriages shaped his life, and his family, including his children, became an integral part of his world. His impact extended beyond the entertainment industry; in 2005, President George W. Bush recognized his contributions to American culture by awarding him the Presidential Medal of Freedom.

The story of Andy Griffith's estate offers a glimpse into the often-private realm of celebrity finances and inheritance. The details of who benefited from his hard-earned wealth remain, to a large extent, shrouded in the mists of privacy. This article aims to delve into the known facts, exploring the circumstances surrounding his death, the value of his estate, and the individuals who may have been involved in its distribution. The narrative underscores the importance of estate planning. For residents in Oakland County, ensuring that their wishes are respected after death is something that demands serious consideration and the careful drafting of estate planning documents, and the importance of safeguarding one's assets and ensuring their distribution according to one's wishes cannot be overstated.

At the time of his passing on July 3, 2012, at the age of 86, Griffith's estimated net worth stood at approximately $60 million. The disposition of this considerable sum, along with the stories of those who were closest to him, became the subject of much speculation and curiosity.

| Full Name | Andy Samuel Griffith |

| Born | June 1, 1926, Mount Airy, North Carolina, USA |

| Died | July 3, 2012 (aged 86) |

| Occupation | Actor, Singer, Writer, Producer |

| Known For | "The Andy Griffith Show" (Sheriff Andy Taylor), "Matlock" (Ben Matlock) |

| Net Worth (at death) | $60 million (estimated) |

| Spouses | Barbara Bray Edwards (m. 19491972), Solica Cassuto (m. 19731981), Cindi Knight (m. 19832012) |

| Children | Dixie Nann Griffith (daughter), Andy Samuel Griffith Jr. (son, deceased) |

| Awards | Presidential Medal of Freedom (2005) |

| Reference | IMDB |

Andy Griffiths life, like that of any individual, was a blend of public persona and private reality. His marriages, the raising of his children, and his personal triumphs and struggles contributed to the man he was. Griffith was married three times. His first marriage, to Barbara Bray Edwards, took place in 1949, before his rise to fame. They adopted two children, Sam and Dixie. Following his divorce from Edwards in 1972, he married Solica Cassuto in 1973. This marriage ended in divorce in 1981. Finally, in 1983, he married Cindi Knight, remaining married to her until his death.

The details of the inheritance are not entirely clear, but it is known that Cindi Griffith, his wife at the time of his passing, was a primary beneficiary. Sources suggest she likely received a substantial portion of the estate, potentially $30 million or more. However, the precise allocation of the remaining funds and assets, and whether his daughter Dixie and the estate of his deceased son, Andy Samuel Griffith Jr., played any roles, remain undisclosed.

Andy Samuel Griffith Jr., tragically passed away in 1996 at the young age of 37. He was a real estate entrepreneur. In the context of the will and inheritance, his untimely death further complicated matters. The distribution of the estate was also complicated by the fact that Griffith's son, Sam, had faced challenges, including battling alcoholism. Dixie Griffith, the surviving daughter, inherited her father's riches. The fact that she was the sole surviving child of the late actor certainly enhanced her position as an heir.

The legacy of the actor is carefully preserved in Mount Airy, North Carolina. There, the Andy Griffith Museum stands as a tribute to his career and contributions to American culture. It houses a vast collection of memorabilia and keepsakes that provide insights into his life and work. The museum stands as an enduring testament to the indelible mark Griffith left on the world. Even a statue of Andy Taylor and Opie, his character in the series, stands in Pullin Park, Raleigh.

The emotional impact of Griffiths passing extended beyond the entertainment world. Roanoke Island locals and devoted fans were taken by surprise when Cindi Griffith obtained a permit to demolish his North Carolina home. While the reasons behind this decision are not publicly clear, it underscores the complex nature of grief, personal legacy, and the decisions that accompany the settling of an estate.

The world will always remember Griffith for his comedic prowess, his ability to touch the hearts of audiences, and his unwavering dedication to his craft. The world will also remember his significant financial success. His estimated net worth of $60 million at the time of his death is a testament to his successful career and the financial rewards it brought. Even with the details of his will remaining largely private, the financial magnitude of his estate clearly reflects the significance of his contributions to the world of entertainment.

The case of Andy Griffith's estate serves as a reminder of the importance of careful estate planning. For individuals in places like Oakland County, it is crucial to have legal documents that reflect their wishes. Without such planning, the division of assets can become complicated, and family relationships can be tested. The value of thoughtful estate planning ensures that an individual's final wishes are honored and that their legacy is protected.

The precise details of how Griffith's estate was distributed remain a private matter. However, what is clear is that he left behind a substantial legacy in both his artistic achievements and his financial assets. The $60 million net worth serves as a reflection of a remarkable career. The disposition of his assets became the subject of much curiosity and speculation, highlighting the need for clear legal documentation to ensure that one's final wishes are respected and that their assets are distributed according to their wishes.

While the specifics of Andy Griffiths inheritance remain a mystery, one thing is clear: He had a profound impact on the world. His work continues to bring joy to millions, and his legacy as a comedic and acting icon is secure. His story also highlights the necessity of planning and considering estate matters for any individual, irrespective of their financial standing. The case of Andy Griffith provides valuable insights into the complexities of celebrity estates and the importance of having appropriate legal documents to safeguard ones wishes and legacy.